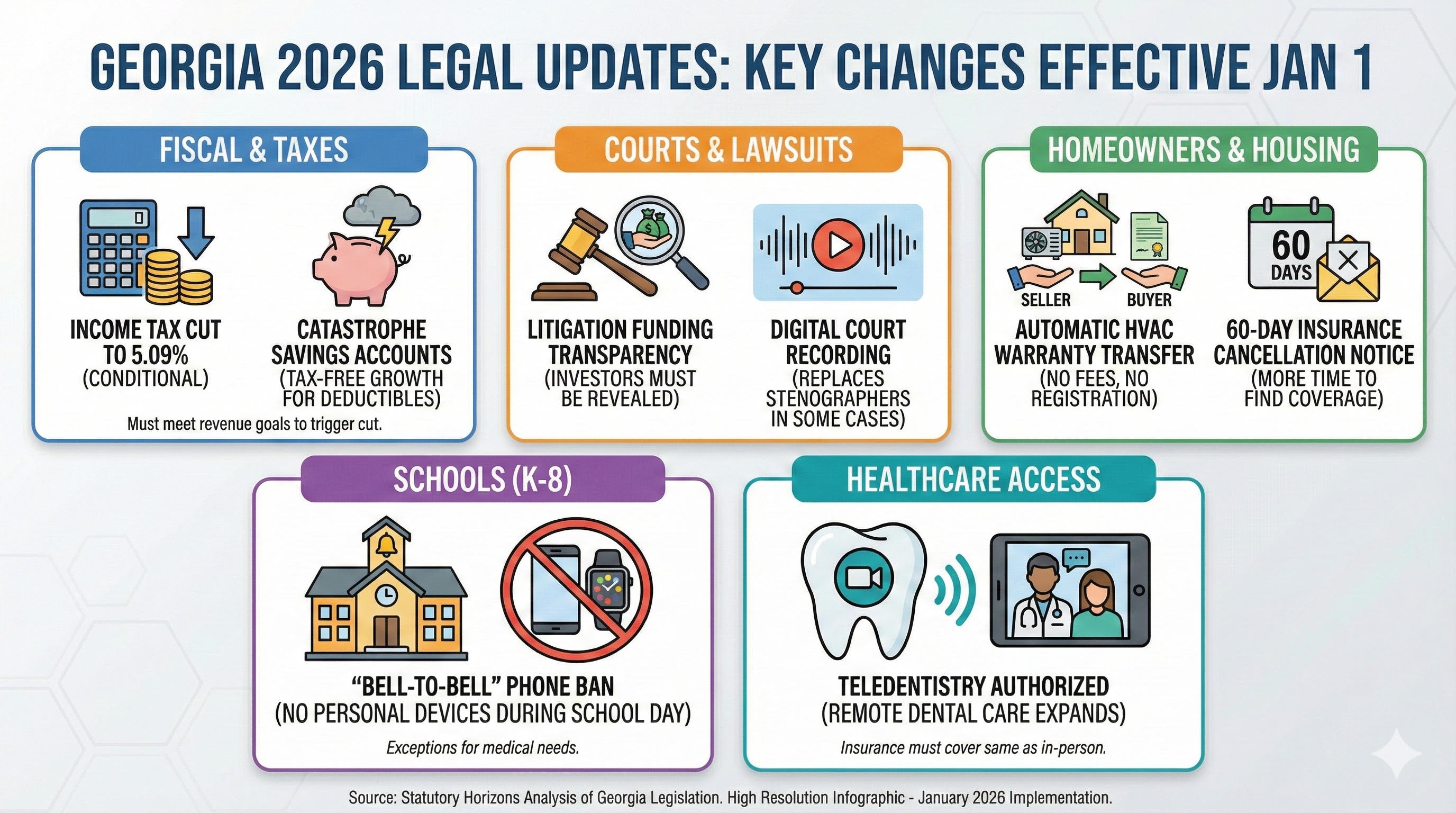

ATLANTA — Starting January 1, 2026, Georgia will enforce a new set of laws that affect taxes, schools, courtrooms, and homeownership. According to a state analysis, these changes mark a shift toward ‘regulated deregulation.’

This approach aims to lower costs for people and businesses while adding stricter rules for specific industries like insurance and lawsuits.

Here is a breakdown of the major changes taking effect.

Your money and taxes

The biggest change involves the state income tax. Under H.B. 111, the personal income tax rate is scheduled to drop from 5.19% to 5.09%. However, this cut is not guaranteed.

The report notes that the Governor’s Office of Planning and Budget must certify that the state has enough money before the cut happens. Specifically, state revenue must grow by 3% and the ‘Rainy Day Fund’ must be full enough to protect the state’s credit rating.

If these goals are met, the rate will drop. The corporate tax rate will also match the personal rate at 5.09%. Supporters believe this will help Georgia compete with states like Florida that have no income tax.

Disaster savings accounts

Because of rising insurance costs and severe weather, a new law (H.B. 511) creates “Catastrophe Savings Accounts.”

Homeowners can put money into these accounts to pay for insurance deductibles. The money put in is tax-deductible, and the interest grows tax-free. If the money is used for ‘qualified catastrophe expenses,’ such as storm damage, it is not taxed when withdrawn.

Changes for homeowners and renters

Two new laws protect people who buy homes or pay for insurance.

HVAC warranties

In the past, when someone bought a used home, the warranty on the air conditioning or heating system often expired or shrank because the new owner did not “register” it in time.

S.B. 112 changes this. Starting in 2026, the manufacturer’s warranty automatically transfers to the new owner when a home is sold. Manufacturers can no longer charge fees for this transfer or require registration. The law states the warranty term must be based on the ‘installation date of the unit’ rather than the sale date.

Insurance cancellation

If an insurance company wants to cancel or not renew a homeowner’s policy, they must now give more warning. The notice period extends from 30 days to 60 days. This gives homeowners more time to find new coverage.

Landlord requirements

H.B. 399 requires landlords who do not live in Georgia to hire a local agent. This agent must be available to handle tenant communications and accept legal papers.

Courts and lawsuits

A major reform targets “Third-Party Litigation Funding.” This is when outside investors pay for a lawsuit in exchange for a cut of the settlement.

S.B. 69 ends the secrecy around this practice. Defendants will now have the right to know if a plaintiff is funded by an investor. The report notes this allows all parties to ‘understand the true financial floor for settlement negotiations.’

The law also bans funding from foreign governments and requires these funding companies to register with the state.

Digital court reporters

Because there is a shortage of stenographers, H.B. 179 allows judges to use ‘digital recording systems’ to create the official record of a trial. Instead of a person typing everything in real-time, courts will keep a digital audio or video file. A written transcript will only be made if someone requests it for an appeal.

Schools and students

H.B. 340 introduces a strict phone policy for younger students. By January 1, 2026, all public schools must ban students in kindergarten through eighth grade from using personal internet devices like smartphones and smartwatches.

The ban applies ‘bell-to-bell,’ meaning students cannot use phones during lunch or breaks. Schools will likely use lockers or pouches to store devices.

Exceptions exist for students who need devices for medical reasons, such as monitoring glucose levels.

Healthcare access

To help rural areas with few dentists, H.B. 567 authorizes “teledentistry.”

This law allows a dental hygienist to work in a satellite clinic or school while a dentist reviews X-rays and creates treatment plans remotely. Insurance companies must cover these appointments just like in-person visits.

Summary

These laws represent a mix of cutting back and tightening up. As the analysis concludes, the 2026 changes bring ‘financial opportunity—through tax cuts and portable warranties—and new social guardrails in their schools and courts.’